A primary reason for the forex market’s popularity among retail forex traders is that it trades virtually around the clock during the usual work week.

In essence, you can get a competitive quote on the active currency pairs from the Sydney open at 5 PM EST on Sunday until the New York close at 5 PM EST on Friday. Although the best times to trade forex tend to be when two major financial centers like Tokyo and London or London and New York are open.

A significant advantage of this 24-hour forex trading is that you can leave a Good ‘Til Canceled or GTC order with your forex broker or bank. Such an order will then be worked overnight or even throughout the week until you request that it be disregarded.

This significantly enhances your chances of being executed at your desired price, which is a good thing if the order involves taking profits at a better level than the prevailing market.

Read our Previous Article: Forex Majors, Minors and Exotics Currencies

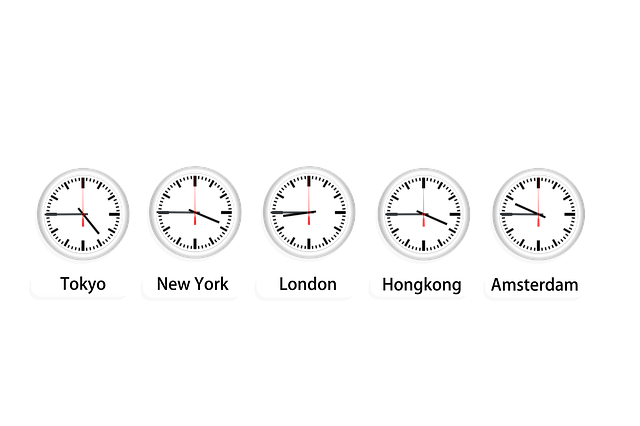

When Forex Trades in the Major Financial Centers

The forex trading day starts at 5 PM EST as the market opens in Sydney, Australia. Nevertheless, the start of this trading session can be quite thin and hence dealing spreads can widen and it may be easier for large traders to trigger stop-loss orders.

Liquidity then grows significantly as Tokyo opens at 7 PM EST. Tokyo’s session subsequently overlaps with the forex market’s primary trading center of London between the hours of 3 AM EST when London opens and 4 AM EST when Tokyo closes.

New York then opens at 8 AM EST. This starts a very active trading period for the forex market as the trading sessions of the major financial centers of New York and London overlap between the New York open at 8 AM EST and the London close at 12 Noon EST.

New York then closes and hands off to Sydney at 5 PM EST, as another trading day begins in the forex market.

Benefits of Trading During Overlapping Sessions

Although the forex market trades around the clock, the forex market is most active when trading sessions for the major forex trading centers of London, New York, and Tokyo overlap.

By having more than one major dealing center open simultaneously, the forex market generally sees a higher trading volume and an improved degree of liquidity that can include better-dealing spreads as market makers in both centers compete for business.

Traders employing short-term dealing strategies like scalping or day trading will often have a better chance to profit during such highly liquid periods.

Fewer Holidays in the Forex Market

Although stock markets tend to subject to closure on bank holidays in the country in which they are located, the forex market observes far fewer holidays, and then usually only partially.

Basically, when a bank holiday closes trading in one country due to a regional, religious or national holiday, other countries that do not celebrate that event often may not close down forex trading at all due to differing cultures.

For example, Asian countries like Japan may be celebrating the Buddha’s birthday and take the day off, while the forex market will generally remain open in the United States, Australia, and Europe.

Although trading may be thinned down somewhat and show tighter trading ranges during such partial holidays, you can generally still get a forex quote if necessary.

Read Next: Forex Market Players – Know Types of Participants