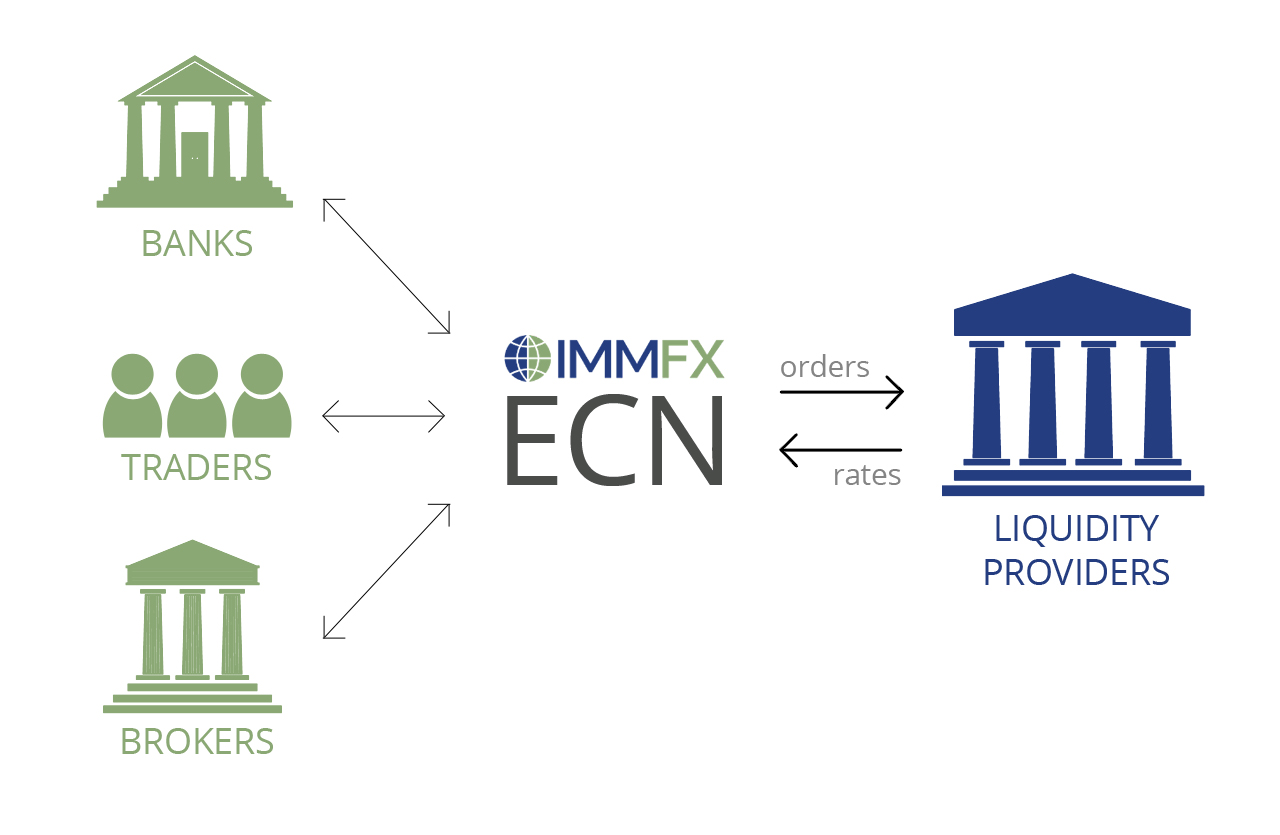

If you are familiar with forex trading, then you would know about its classifications “Market Maker” and “ECN”. ECN or Electronic Communications Network provides a marketplace where banks, market makers, and individual traders buy and sell to each other by sending competing bids and offers into the system. All parties interact with each other in the network and they are given the best offers for their trades at any given time, and the orders are matched against other participants in real time. All services are provided for a small fee.

ECN is relatively new and IMMFX has recently started offering this service for its customers, particularly because of the many advantages it has. For instance, ECN does not have a fixed spread, and this means that spreads will mostly be based on the buying and selling rates in the market.

However, this is not the only advantage of ECN trading. Here are some additional benefits that will help you reach a verdict on ECN trading systems:

ECN is Flexible

If you have traded with a forex broker, chances are that you were offered a fixed spread. Of course, this is perfectly all right if the buying and selling rates are good. However, these rates remain the same despite any fluctuations in the market.

As an ECN broker, IMMFX can guarantee success to a great degree to investors because of the system’s flexibility. ECN adapts to rates in the market in a way that makes traders confident about their investment.

Straight Through Processing

In the ECN system, traders do not have to go through dealing desks. Your money will go straight to the interbank market without any interruptions. This is known as straight-through processing (STP) and it makes the life of traders easy as they do not have to go through dealing desks.

Access to Information

While traders on ECN remain anonymous (which is a benefit in itself), you can view the orders that have been made and sold without any difficulty. This will help you analyze market depth, which in turn enables you to make better buying or selling decisions.

Even with the anonymity factor, all the orders in the market and their rates can easily be viewed. This also increases transparency as the status and ratio of demand and supply is open for all to see.

Final Thoughts

Many times people confuse STP brokers with ECN brokers. ECN brokers provide you with direct trading on the real market, whereas STP brokers are a mix between ECN brokers and market makers. Other benefits of ECN forex trading include the fact that in this system, the deals of the traders are not carried out against the broker, which is not the case with market makers. To get started with ECN, you need to open a forex trading account with IMMFX.