Forex trades are carried on widely these days and in order to emerge successful in the highly volatile area, one need to master the techniques and strategies of trading. Apart from this, you need to use the right tools and equipment as well. There are different types of Forex order.

Knowing the types of Forex order and the details surrounding it will enable you to turn out good results in the Forex trading.Understanding the basics about Forex order is important and below you will get to know about the types of order that are employed by traders all over the world,

Understanding the basics about Forex order is important and below you will get to know about the types of order that are employed by traders all over the world,

Forex Order Types

Market Order

Market order is a kind of Forex order where buying and selling activity takes place based on current market price. It is used for getting in or getting out of a particular trade. This can prove out to be little risky and proper planning and execution is required if wants to get splendid results. The market price when you are buying the share and the market price when you are selling the same can be completely different and could move up and move down to a considerable extent.

Limit Entry Order

This type of Forex order enables buying and selling within a certain limit. In this type of Forex order, the currency could be bought for a specific price and sold at some other price. Buying and selling of currency take place above or below the market price.

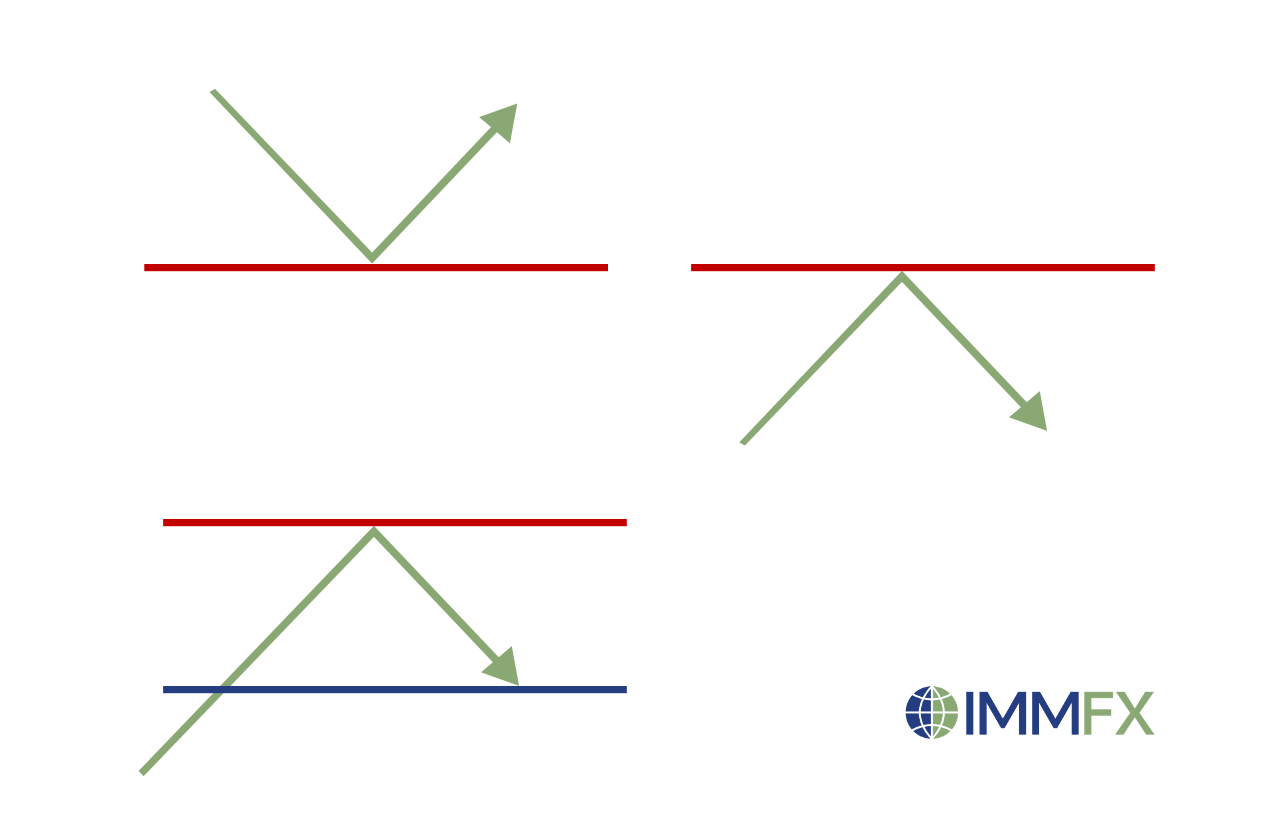

Stop Entry Order

This type of Forex order is to buy over the market price and sell below the market price. If the market goes against the expectations of the trader, then it could be used as stop loss Forex order in order to prevent losses.

Stop-Loss Order

In this type of Forex order, the trader will sell a particular currency only if the market goes below the expected point set by the trader for Forex trading.

Trailing Stop

A trailing stop order is a Forex order that is fixed for a percentage of the market price and aimed at a long term position. As the price goes up and down, the trailing stop is adjusted accordingly.

Forex Order: Weird Orders

Good ‘Till Cancelled (GTC)

Forex order that is placed just a few points away from the current market price. The shares will be sold once the market price reaches the quote provided by the trader. The order will automatically expire if the market does not reach the quote at the end of the particular trading day.

Good for the Day (GFD)

It is a limit Forex order with the facility to buy and sell at the end of the stipulated period which may be a month or a day as well. The Forex order will expire if the quote is not met with.

One-Cancels-the-Other (OCO)

As per this Forex order, two orders will be placed and upon the execution of one order, the other one gets canceled automatically. Using an automated trading platform, one stop order, and one limit order needs to be placed. This type of Forex order is the best when it comes to bringing down the level of risks in trading.

One-Triggers-the-Other

Two orders are placed and the execution of one order triggers the other one in this type of Forex order.