If you are new to trading forex, then you may make some common mistakes. To avoid making mistakes, you need to educate yourself and understand what you are doing. Forex trading can be tricky, but with the right education and information, you can increase your chances of trading successfully.

Here are the five most common forex trading mistakes that are often made by traders.

Trading Without a Specific Method

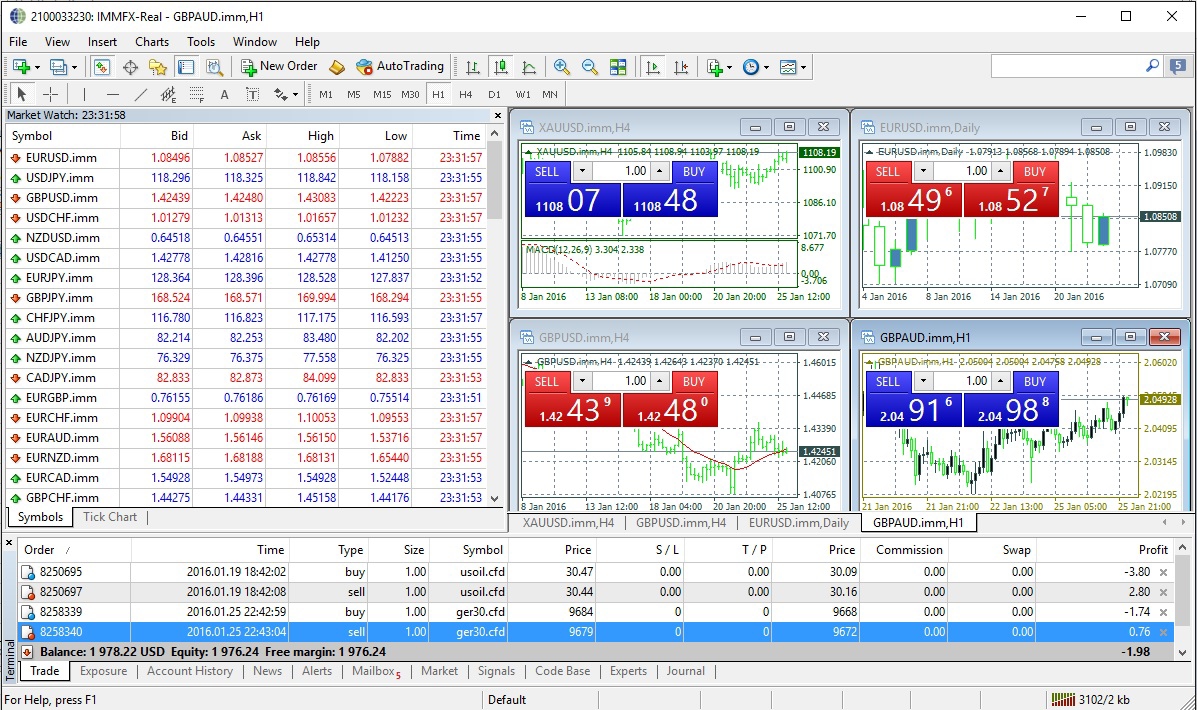

Novice traders generally do not follow a specific trading method or system. More often than not, they just guess market movements. To avoid doing this, you need to develop a specific trading method and always follow it. To do this, you need to choose the analytical tools needed to trade the forex market. You can start with tools such as charts, technical indicators, trade signals and economic calendars. These tools will help you identify market trends and increase the probability of successfully entering and exiting the markets, and help you manage risks. Whichever tools you decide to use, you need to understand their usage and apply them correctly.

Not Following a Specific Trading Plan

Another common mistake that novice traders regularly make is that they create a trading plan or method but they do not follow it. Therefore, you must define a trading method that works best for you and then stick to it at all times. You must always be disciplined. Remember, do not trade your emotions just trade the facts!

Expecting Too Much Too Quickly

Many traders expect quick, unrealistically high returns. Although it is possible to get high returns, it is difficult to do it without taking on high risks. You need to develop realistic expectations to increase your chances of being a successful trader. Thus, manage the risks and you will have a higher chance of being rewarded.

Making Trades Impatiently

Usually, new traders are not patient when they are making trades. Because trading can be so exciting, new traders want to trade all the time, but it means that you can over trade and trade at a much lower standard. So being patient is important. And patience is also important over the long term. The longer you’re trading and gaining experience, the more likely you will be successful over time.

Lack of Proper Money Management

One of the biggest mistakes that traders make is not managing their money properly. Without proper money management, you won’t be able to limit your trading losses or maximize your profits. Ensure you do not forget about the risk of forex trading. With proper money management, you can limit your risk on every trade so that you will be able to make additional trades.

Final Note

If you want to avoid making common mistakes, you need to take the time to learn and properly educate yourself. You would not see top athletes entering a competition without proper training and practice; thus, you should not trade unless you know what you are doing. Once you have the knowledge and experience, then you can be successful in forex. Start trading only when you are ready.