Forex trading is a relatively easy activity to understand and perform. Despite this, it has caused countless financial losses over the years as a result of limited market knowledge, ill-executed trades, and poor money management.

To become a long-term trader with a positive FX trading record you need to follow a certain number of steps to enhance your chances of augmenting your forex trading account balance. One of the first steps towards enhancing your forex trading account balance is to ensure that you select a reliable forex broker who upholds the strictest trading standards.

Choosing the Right Forex Broker

Your chosen forex broker can help you enormously to enhance your account balance with proper money management. The first step in selecting a broker is to find someone who is reliable and have mostly positive reviews, as this ensures utmost protection of your funds under all circumstances.

Another reason to carefully select a broker is to ensure that they offer superior trading tools and a complete range of forex trading services, including professional, around-the-clock support. With the right support, tools, and resources you will soon learn how to execute your trades in accordance with your level of risk and your goals as an online trader.

Why trade forex with IMMFX?

- Licensed broker

- Low spreads

- Full Hedging Capability

- Swap Free Account

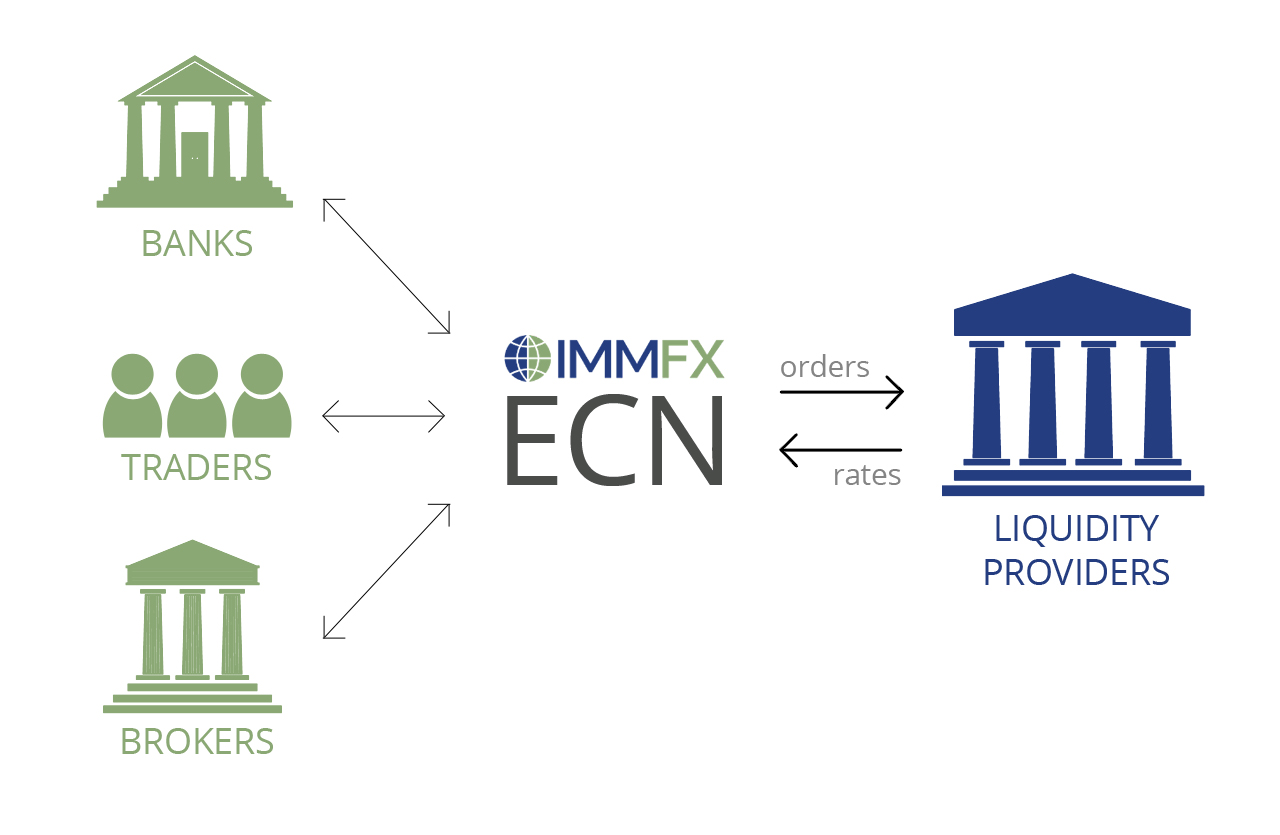

- Deep liquidity

- Safety of Funds

Money Management Strategies

Listed below are more forex trading money management strategies that should be followed to enhance your trading account balance…

- Use small lot size for greater flexibility and reduced risk

- Limit your use of leverage on the trading platform

- Use predetermined stop losses to control losses on a trade

- Always follow your trading plan

- Seek forex trading opportunities where rewards go beyond risk

Staying informed of the market

- Attend conferences, seminars, and events, whether they are held locally or on the internet

- Network with other online traders

- Discuss ideas in forums and Forex blogs

- Read forex news, economic releases and financial reports

- Watch the latest forex news, market videos and headlines

- Teach a friend all about trading forex – it’s a great way to understand the market from a fresh perspective

- Test new FX trading strategies on a demo trading account to see which strategy generates the most profitable results