When it comes to markets that are most affected by economic changes, the Forex trading market is ranked amongst the top ones. With buyers and sellers coming together from different corners of the world to participate in the trading of large sums of money every day, there is a huge impact of global economic factors that affect the forex market.

As these markets are getting more and more globalized, it has become very important for those operating in this market to understand the impacts of different macroeconomic aspects on the working of Forex trading. Here are some important global macroeconomic factors that should be observed closely if you are planning to become successful in the Forex trading market.

International Trade

The demand for a country’s products in the global trade market is another factor that affects the value of its currency in the Forex trading market. If a country is producing goods that are in high demand in the trade market, the value of their currency is likely to be appreciated since more people would like to do trade transactions with them.

Deficits and surpluses in the international trade market are another global macroeconomic indicator of a country’s currency valuation trend in the future. Countries with an international trade deficit are likely to go through a currency devaluation period while those with surpluses can experience an increase in their currency rates.

Capital Markets

Capital markets are another major global macroeconomic factor that should be monitored by Forex traders. Changes in capital markets are another indicator of where an economy is headed in the financial aspect. The biggest advantage here is that the capital markets of any country are among one of the most transparent markets, with all up-to-date data readily available through a number of sources.

A change in the trading trend of capital and securities can be a big indicator of the direction of the market. If a country is selling off too many securities in the international capital market all of a sudden, it clearly indicates a change in the investor’s attitude towards the country, which will definitely affect the value of its currency in the Forex trading market.

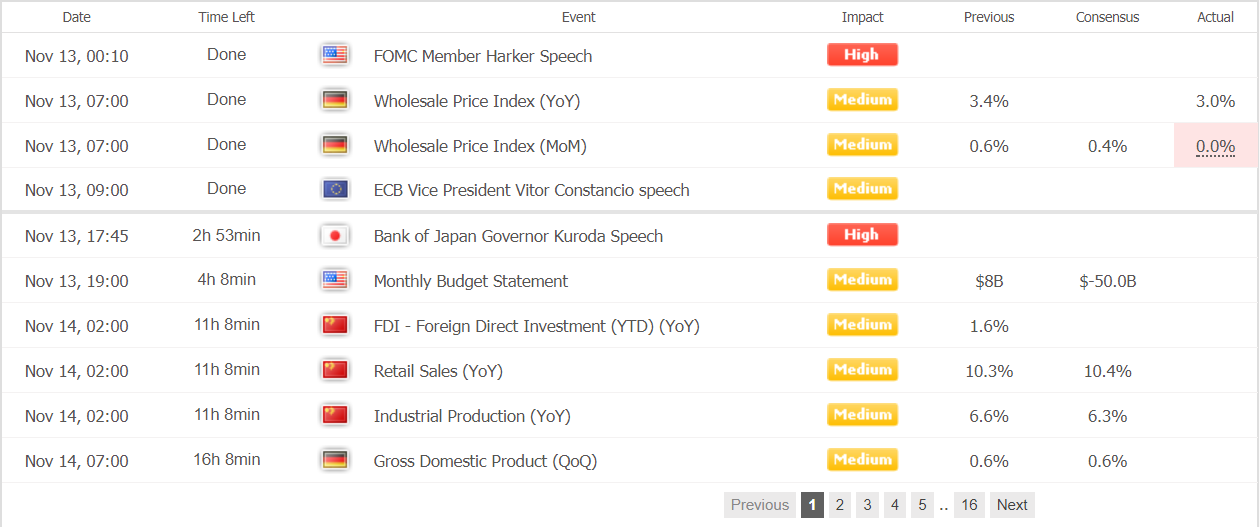

Economic Releases

One of the most important things that you should keep an eye out for is the economic reports of the different countries involved in the Forex trading markets. These reports include the GDP, inflation, employment rate and several other reporting factors that play a very important part in making or breaking the economy of a country.

In the Forex trading market, however, keeping track of inflation rates and trends of currency rate fluctuations in different countries is one of the most important things to do. Depending on the countries policy and its outlook, inflation is one of the major factors that can often work as a double-edged sword.

GDP reports, while a very important global macroeconomic factor, come second because they are the lagging indicators. They are usually made available when things are already done and cannot be changed. While it can give you an idea of a country’s strengths and weaknesses, it cannot help you in changing events that have gone by. You can get the latest news updates and economic releases from our Economic Calendar.